OUR FOCUS

How we work for you:

We Buy:

Underperforming assets with room for value add appreciation .

By utilizing conservative underwriting*

To maximize tax benefits to investors through depreciation and (in many cases) cost segregation

To communicate consistently and quarterly to all investors

To follow SEC guidelines and guidance

Properties that we transform into stronger communities

Rising Demand for Rentals:

Over 36% of U.S. households now rent, and this number is growing as homeownership becomes less affordable due to rising interest rates and home prices.

State of Other Buildings:

Many older buildings are becoming mis-managed and need updating which is one of our core strategies. These can and do become vibrant communities with waiting lists with strategic improvements.

Hedge Against Inflation:

Multifamily rents have historically outpaced inflation, providing investors with a reliable way to preserve purchasing power over time.

Demographic Tailwinds:

Millennials and Gen Z — representing over 50% of the U.S. population — are delaying homeownership and fueling long-term rental demand. Meanwhile, retiring Baby Boomers are downsizing into maintenance-free living.

Stable Cash Flow:

Unlike stocks or crypto, apartments produce monthly recurring income through rent, making them ideal for investors seeking consistent cash flow with potential for appreciation.

Tax Benefits:

Real estate investors benefit from depreciation, 1031 exchanges, and pass-through deductions, reducing taxable income while building equity.

Affordability Crisis = Opportunity:

As of 2024, over 50% of renters are cost-burdened, meaning they spend more than 30% of their income on rent — creating strong demand for well-managed, reasonably priced multifamily housing.

Institutional Confidence:

Major funds and REITs continue to acquire apartments, with multifamily assets accounting for over 40% of commercial real estate transactions in recent years — signaling strength and confidence in the sector.

Apartments outperform stocks and bonds

Investing in apartments is wise for those who want to avoid high-risk investments. Not only can multifamily investments bring tremendous equity growth, but they can provide monthly income more significant than what you would get from stocks and bonds, making it an even better choice if your goal is maximizing return on investment while minimizing the risk of your portfolio.

Multifamily investments outperform other real estate classes

Apartments have been the best investment amongst all other real estate classes. Because of the nature of multifamily properties and how we structure our investment properties, we can make significant cash flow plus equity growth which yields higher overall returns than all other real estate asset classes.

Apartments outperform stocks and bonds

Investing in apartments is wise for those who want to avoid high-risk investments. Not only can multifamily investments bring tremendous equity growth, but they can provide monthly income more significant than what you would get from stocks and bonds, making it an even better choice if your goal is maximizing return on investment while minimizing the risk of your portfolio.

Multifamily investments outperform other real estate classes

Apartments have been the best investment amongst all other real estate classes. Because of the nature of multifamily properties and how we structure our investment properties, we can make significant cash flow plus equity growth which yields higher overall returns than all other real estate asset classes.

Take Advantage of Increased Tax Benefits

Our Team only acquires stabilized (above 80% occupancy) and cashflow positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

Take advantage of 3 types of depreciation that allow investors to lower taxes:

Standard or Straight-line Depreciation

Accelerated Depreciation

Bonus Depreciation

Cost segregation studies are performed on all of our assets. Tax benefits also pass through to our investors via annual year-end reporting on K-1s issued for the preceding year.

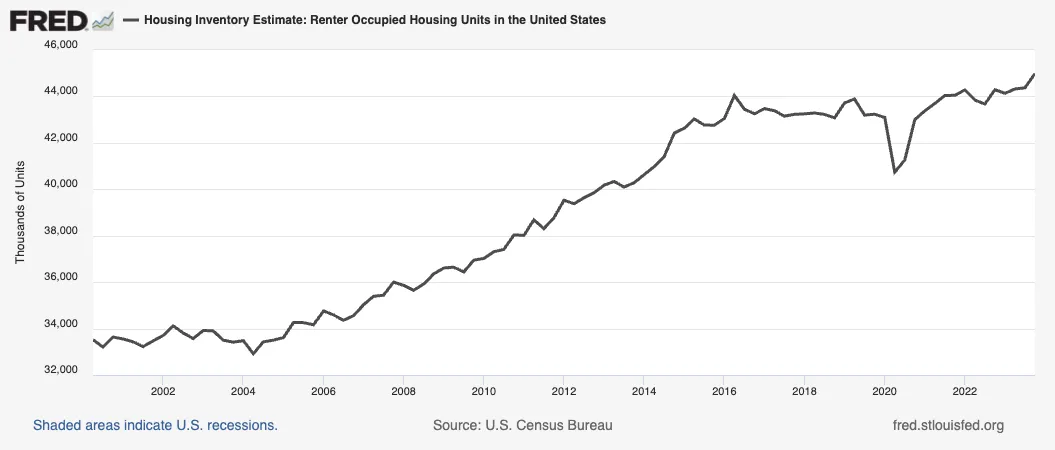

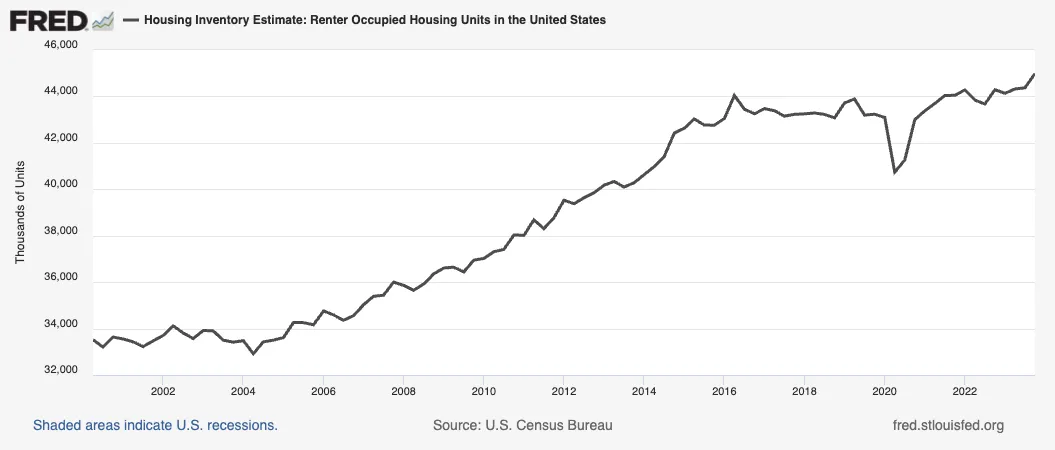

Demand for apartments is at an all-time high and still climbing

Since its peak in the mid-2000s, home ownership has been significantly dropping, and it will continue to drop as millennials, and aging baby boomers want to stay mobile in the 21st century.

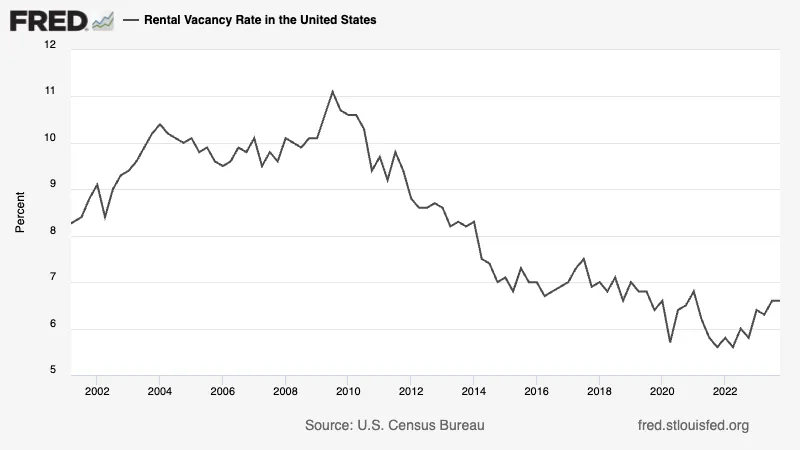

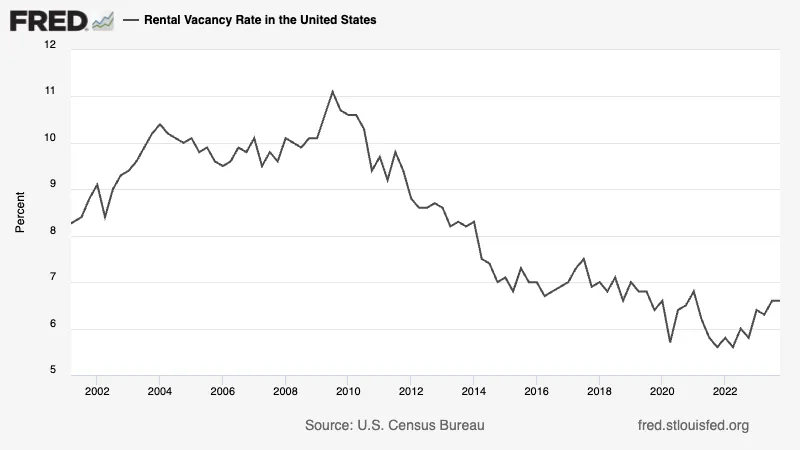

Vacancy rates remain low due to increased demand

With the population continuing to increase, demand for apartments is at an all-time high. This increase drives the need for apartment living higher and higher. Low vacancy rates equal more significant cashflow and equity growth, which translates to higher returns for our investors.

The information provided herein is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any projections, estimates, or expectations provided are hypothetical and are not guarantees of future performance. Past performance is not indicative of future results. All investments involve risk, including the potential loss of principal. Prospective investors should conduct their own due diligence and consult with their legal, tax, andFull Width financial advisors before making any investment decisions.

Demand for apartments is at an all-time high and still climbing

Since its peak in the mid-2000s, home ownership has been significantly dropping, and it will continue to drop as millennials, and aging baby boomers want to stay mobile in the 21st century.

Vacancy rates remain low due to increased demand

With the population continuing to increase, demand for apartments is at an all-time high. This increase drives the need for apartment living higher and higher. Low vacancy rates equal more significant cashflow and equity growth, which translates to higher returns for our investors.